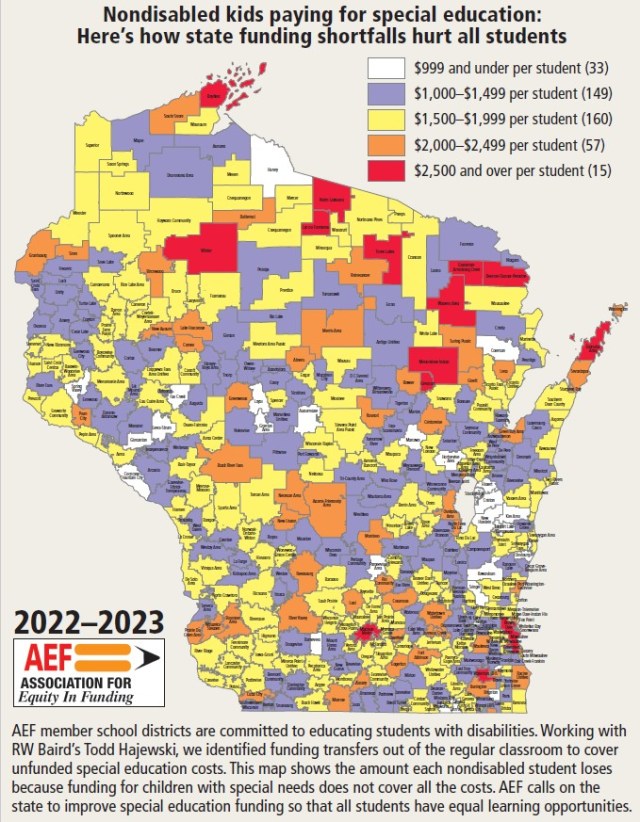

State and federal funding cover less than half of the costs of educating children with special needs in Wisconsin. School districts have to use funds from the regular education budget to cover unfunded special education costs. The map below shows that these transfer amounts can run into the thousands of dollars taken from students without special needs. This is why additional special education funding helps all students and will not be used to hire more special education staff. A recent Marquette Law School poll found an overwhelming majority of WI voters (76%) favor a major increase in funding for special education. AEF calls on the legislature to improve special education funding so that all students have a fair opportunity to learn.

More details and links to high-resolution versions of the maps can be found below.

Download a high-resolution version of the 2022-2023 special education funds transfer map here.

Download a high-resolution version of the 2023-2024 special education funds transfer map here.

Wisconsin has a long history of supporting the education of children with disabilities. In fact, our special education laws predate the federal law. As far back as 1939, the legislature allowed for the education of students with special needs. In 1967, Attorney General Bronson La Follette opined that all “handicapped children had the right to a free public education.” In 1973, upon the passage of the law creating, there were concerns about funding, as the bill was trimmed to reduce the state’s cost. It was signed by Governor Lucey on August 1, 1973.

It was recently reported that “When the Individuals with Disabilities Education Act was passed in 1975, it authorized federal funding for up to 40 percent of what it costs to provide special education services for students with disabilities. But the federal government has never come close to funding at that level, hovering closer to 15 percent.” One of President Ford’s biggest concerns upon signing the federal special education bill was that federal funding would not be adequate to the demands the law would place on districts. Indeed, his predictions have come true–the state and federal commitment has fallen well behind costs. AEF has worked to make it clear exactly how much funding has to be taken from other sources to cover unfunded special education costs.

Let’s start with the very important premise that AEF member school districts are fully committed to educating students with disabilities. It’s the right thing to do and school districts spend millions of dollars to hire many professional teachers, specialists, and paraprofessionals every year to make sure children with special needs make progress commensurate with their abilities. But we can use budget data to show that these costs cut into the education of other students in ways that have a significant impact. That impact is made very clear in every school district’s annual budget through a transfer from regular education into special education. Here’s how it works:

Special education costs are entirely allocated from a specific, numbered account called “Fund 27.” That account is used to pay for everything associated with special education: staff members, equipment, special bussing, etc. The account is funded with state and federal aid for the purpose of educating children with disabilities. At the end of each fiscal year on June 30th, accounting rules prohibit a negative balance in Fund 27. The fund has to be “made whole.”

In contrast, the General Fund is called “Fund 10.” It’s where state aid and local taxes are deposited and is used to pay for regular education classroom teachers, school secretaries, textbooks, buses, and utilities, but not for students with disabilities. Districts can take money from Fund 10 to cover expenses but funds cannot go in the other direction, and in fact, districts take money from Fund 10 to cover shortfalls in Fund 27 every year. In other words, after all the income is put into Fund 27 and all the special education costs are taken from it, whatever isn’t covered, whatever the negative balance amounts to, is taken from Fund 10. It’s a challenge for districts and it’s also a very obvious number to identify in school district budgets.

AEF was interested in the amount of funding taken from Fund 10, the general education fund, to cover unfunded special education costs. We asked RW Baird’s Todd Hajewski to identify the exact transfer amount from Fund 10 to Fund 27 in every school district for the last two fiscal years. But unlike some other studies, we chose to examine the impact of that transfer amount on nondisabled students. In order to identify that cost, we divided the Fund 10 to 27 transfer amount by the number of students without IEPs to document the burden of the special education mandate on the rest of the students in the school district. The maps show the amount transferred from each nondisabled student because funding for children with special needs does not cover all the costs. Specifically, the maps show the Fund 10 to Fund 27 transfer amounts divided by the number of students without special needs.

There are a couple of key points to consider in the maps. First, looking at fiscal 22-23, almost 3/4 of school districts (309 of 421) are transferring between $1000-$1999 per nondisabled student to the special education fund. Consider what an additional $1000 or more per student could do in a classroom. We also note that 15 districts were transferring more than $2500 per student. Next, look at the map covering fiscal 23-24. The number of districts transferring more than $2500 per student has more than doubled from 15 districts to 31. Special education funding from the state went up in the last state budget, but this is a strong indication that costs are going up faster than funding rates are increasing, putting an even greater pressure on schools to make ends meet.

Some people think that providing additional special education funding will go to hire more special educators. In fact, our research suggests that it’s more likely to “backfill” funding that is currently being taken to make sure Fund 27 is covered at the end of the fiscal year. Now for the politics and perception.

A recent Marquette Law School poll included questions about funding for special education. They reported, “A majority (76%) favor a major increase in funding for special education in the schools, while 23% are opposed. Majorities of all partisan groups favor increasing special-education budgets…” It appears that there is an issue on which just about everyone is in agreement: it’s time to improve funding for special education. AEF calls on the state to improve special education funding so that all students have adequate learning opportunities.